In the world of online investments, promises of huge returns in a short time often turn out to be scams. One such scam that has recently come to light is Vicionpower, an investment platform that claims to offer an incredible 200% return after one year. While such high returns might seem tempting, they are often used as a tactic to lure unsuspecting individuals into fraudulent schemes.

Thank you for reading this post, don't forget to subscribe!In this blog, we will review the Vicionpower scam, provide key warning signs, and explain how you can avoid falling victim to similar scams. It’s important to remain cautious, especially when these platforms target vulnerable groups like older individuals.

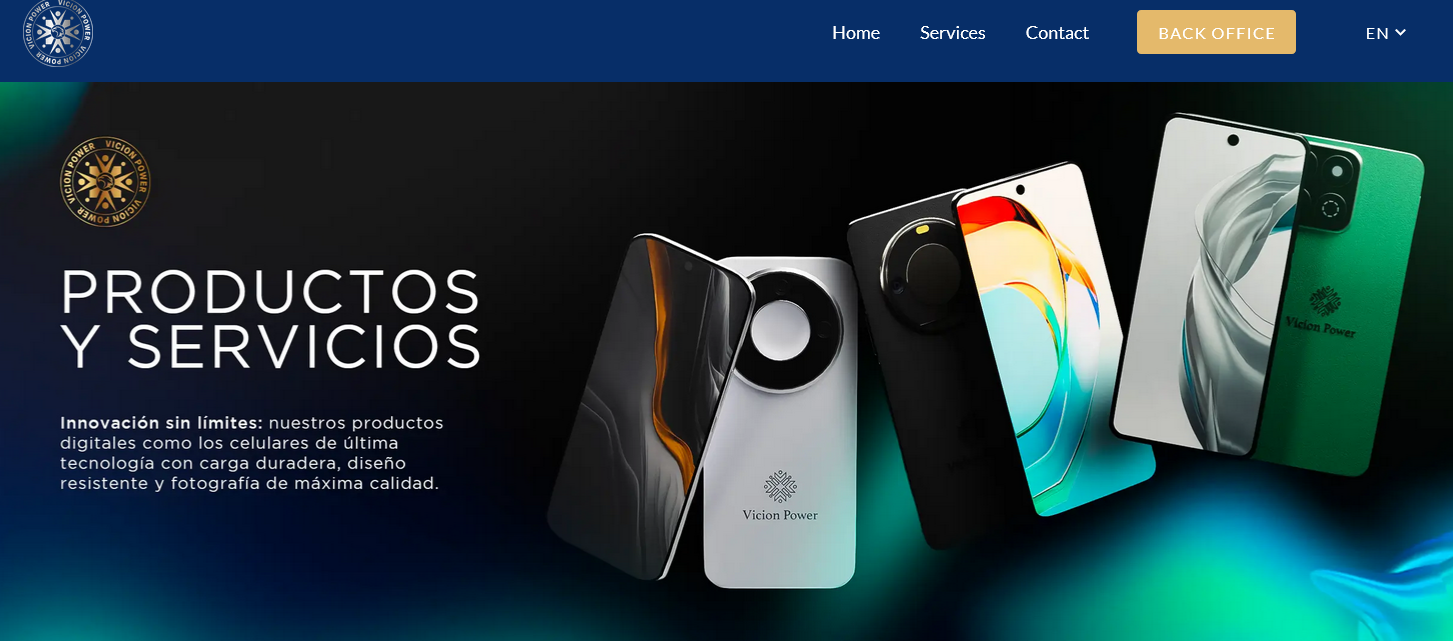

How the Vicionpower Scam Operates

The Vicionpower scam starts with the promise of unrealistic high returns. In this case, the scammers claim that they will return 200% of an investment after just one year. This is a classic red flag in the investment world. No legitimate platform would guarantee such returns, especially in a high-risk space like investments. High returns generally come with high risks, and it’s crucial to understand that any platform making such promises without clear, verifiable backing is likely to be a scam.

Once potential victims show interest, they are encouraged to invest a certain amount of money into the platform. In this particular case, a victim reported losing $4,000. After making the investment, the investor was left with no updates, no contact, and no way to withdraw the funds — all signs of a typical advance-fee scam.

Why Vicionpower Looks Like a Scam

There are several red flags that suggest Vicionpower is a scam:

- Unrealistic Promises: Offering a 200% return after one year is an offer that sounds too good to be true. Legitimate investment platforms cannot guarantee such returns, especially without clear details on how the investments will generate profits.

- Lack of Communication: After the victim made the investment, they reportedly never heard from the platform again. Communication lapses are a significant sign that you’re dealing with a scam. Legitimate platforms provide regular updates and have reliable customer service channels.

- Unclear Ownership: The Vicionpower website lists no clear information about who owns or operates the platform. Transparency is essential in any legitimate business, and the absence of it is a major warning sign.

- Unregulated Platform: Vicionpower does not appear to be regulated by any recognized financial authorities. Without proper regulation, there’s no oversight on how your funds are managed, and no way to resolve any issues that may arise.

- Targeting Vulnerable Individuals: Scammers often target older people, especially those who may not be as familiar with the risks of online investments. The lack of clear information and the appeal of a large, guaranteed return can be especially enticing for this demographic.

Protect Yourself from Investment Scams Like Vicionpower

To avoid falling victim to scams like Vicionpower, here are some important tips:

- Be Skeptical of High Returns: If an investment promises returns that seem too good to be true, they likely are. Even in high-risk markets like cryptocurrency, no legitimate platform guarantees returns like 200% in just one year.

- Verify Regulatory Status: Always check whether the platform is registered with a financial regulator. Regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA) exist to protect consumers and ensure fairness in financial markets.

- Research the Company: Before investing, conduct thorough research into the platform. Look for reviews, complaints, or any official warnings issued by regulatory bodies. If the company is hard to find or has a lack of transparency, it’s a major red flag.

- Do Not Send Money Without Research: Never send money to a platform that you don’t fully trust or understand. Upfront fees for “unlocking funds” or “paying taxes” are classic signs of a scam.

- Report Suspected Scams: If you suspect that you’ve been targeted by a scam, report it immediately to your country’s financial regulatory authorities or consumer protection agencies. In the U.S., this could be the Federal Trade Commission (FTC) or the Securities and Exchange Commission (SEC).

Final Thoughts on Vicionpower and Other Investment Scams

Scams like Vicionpower continue to target unsuspecting investors with promises of high returns and minimal risk. However, as we’ve seen with many scams, the reality is that victims often lose large amounts of money and have no way of recovering their funds. Vicionpower, with its promises of a 200% return and lack of transparency, is a perfect example of how scammers manipulate vulnerable individuals, especially older adults.

Remember: the best way to protect your money is through education, due diligence, and research. Before making any investment, always verify the legitimacy of the platform, check for regulatory registration, and avoid any platform that guarantees high returns without clear and transparent risk disclosures.

Report and Learn More

If you believe you’ve been targeted by a scam like Vicionpower, you can report it to the Federal Trade Commission (FTC) or your local consumer protection agency. For more tips on how to spot and avoid investment scams, visit BrokersReporter.com, your trusted source for information and scam prevention.

Want to check whether a broker is trustworthy before you invest?

If you are seeking a verified source of information, analysis, and safe trading options on BrokersReporter.com, please visit us.

For more verified facts, scam reviews, and detailed guides on how to select a safe forex broker, visit us for comprehensive forex-related content and keep your investments secure.