False Swiss Investment Claims and Red Flags Investors Should Not Ignore

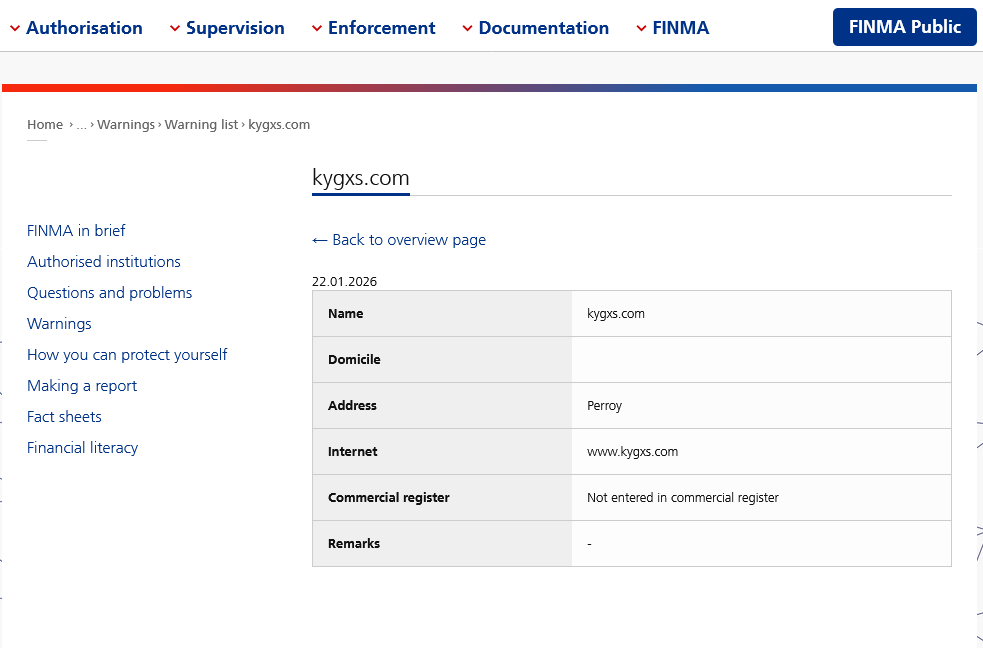

Kygxs.com is an online investment website operating with the same high-risk patterns seen in many fraudulent trading and crypto platforms. Despite presenting itself as a professional and established financial firm, the available evidence strongly suggests that its claims are misleading and designed to lure unsuspecting investors.

Thank you for reading this post, don't forget to subscribe!The platform attempts to gain trust by associating itself with a supposed Swiss investment entity and by using polished language around long-term financing and financial integrity. However, these statements do not align with verifiable facts.

False Claims About Kahyx Capital Sàrl

Kygxs.com states that it is connected to Kahyx Capital Sàrl, claiming the company was established in 2019 in Perroy, Switzerland, with over four decades of global project participation and equity investment experience.

These claims appear to be used purely as a credibility tactic. There is no reliable public evidence confirming that kygxs.com is legitimately connected to a regulated Swiss financial institution or that it holds authorization to provide investment or financial services.

Using Switzerland’s reputation for financial stability is a common tactic among deceptive platforms attempting to appear legitimate.

Unlicensed and Unregulated Operations

Kygxs.com does not provide:

- Verifiable regulatory licenses

- Recognized financial authority registration

- Transparent company ownership details

- Audited business records

Offering financial products or services without proper authorization places investors at extreme risk, especially in areas such as:

- Crypto and digital asset investments

- Forex and derivatives trading

- Long-term debt or equity financing

Unregulated platforms are not held accountable to investor protection rules, dispute resolution mechanisms, or financial reporting standards.

Promises Designed to Attract Victims

The website promotes itself as a private investment firm offering:

- Tailored long-term debt financing

- Competitive interest rates

- Strategic investment partnerships

- Financial integrity and trust

In reality, these are common buzzwords used by fraudulent investment schemes to give the illusion of professionalism while hiding the lack of real operations.

Promises of stable or competitive returns without transparent risk disclosures are a major warning sign.

Pressure Tactics and Behavioral Red Flags

Reports associated with platforms like kygxs.com often involve:

- Pressure to invest quickly

- Claims of limited availability or exclusive opportunities

- Urgent requests to deposit funds

- Vague or evasive responses when questioned

- Poor or nonexistent customer support

These tactics are intentionally used to prevent victims from conducting proper due diligence.

Similarities to Other Known Scam Platforms

Kygxs.com operates in a manner similar to Global Trading Investment and other unlicensed investment websites. The pattern is consistent:

- Professional-looking website

- Fabricated company history

- No regulatory backing

- High-reward investment language

- Disappearing accountability once funds are sent

Once money is transferred, investors often face withdrawal restrictions, silence, or complete account lockouts.

What to Do If You’re a Victim

If you’ve lost funds on Galidix or a similar platform:

- Notify your bank or payment provider immediately

- Preserve evidence such as transaction records and screenshots

- Report the incident to your local financial authority or cybercrime unit

- Consult cyber intelligence professionals to explore recovery options

Final Thoughts

Kygxs.com raises multiple red flags that strongly indicate it is not a legitimate investment platform. The false association with a Swiss entity, lack of regulation, and misleading financial claims suggest a deliberate attempt to deceive investors.

Anyone considering investing through this platform should stop immediately and seek independent verification from recognized financial regulators. Protecting your capital starts with avoiding platforms that rely on unverifiable claims and manufactured credibility.

Want to check whether a broker is trustworthy before you invest?

If you are seeking a verified source of information, analysis, and safe trading options on BrokersReporter.com, please visit us.

For more verified facts, scam reviews, and detailed guides on how to select a safe forex broker, visit us for comprehensive forex-related content and keep your investments secure.