The “Wave Capital FX” (or “Capital Wave FX”) is widely recognized as a potential danger in the world of online trading. The company advertisements propose a smooth route to making money; on the other hand, a coalition of regulators around the globe has warned against the company.

Thank you for reading this post, don't forget to subscribe!The following Wave Capital FX review examines the reasons behind the fraudulent practices attributed to Wave Capital FX, highlighting key points that retail investors should consider before putting their money at risk.

Is Wave Capital FX a Regulated Broker?

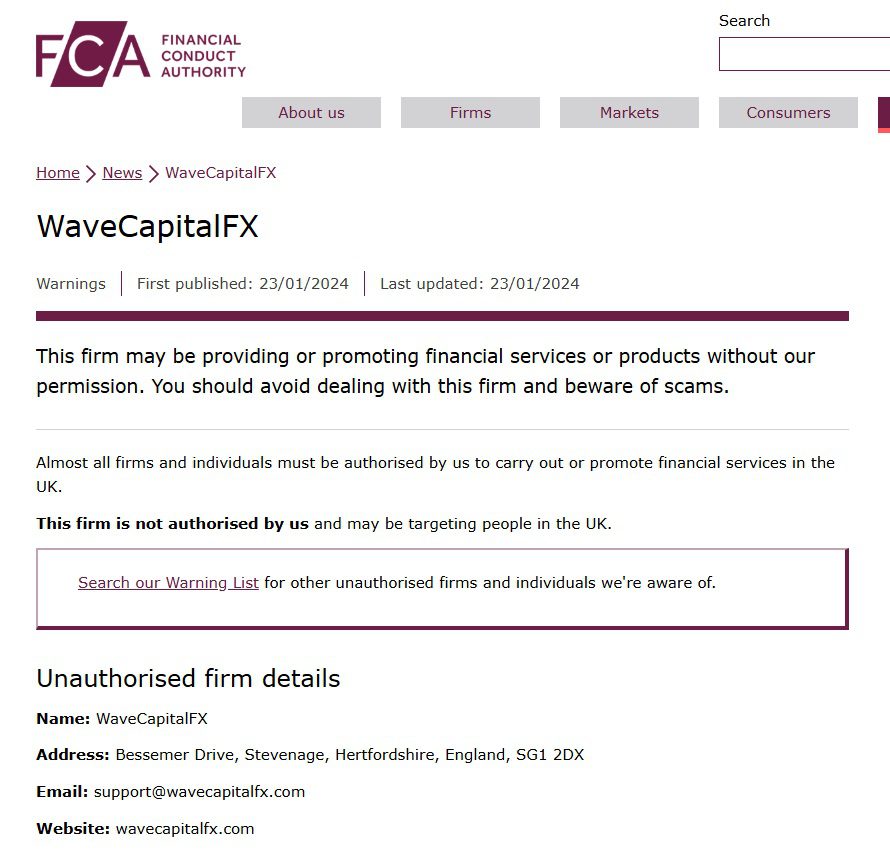

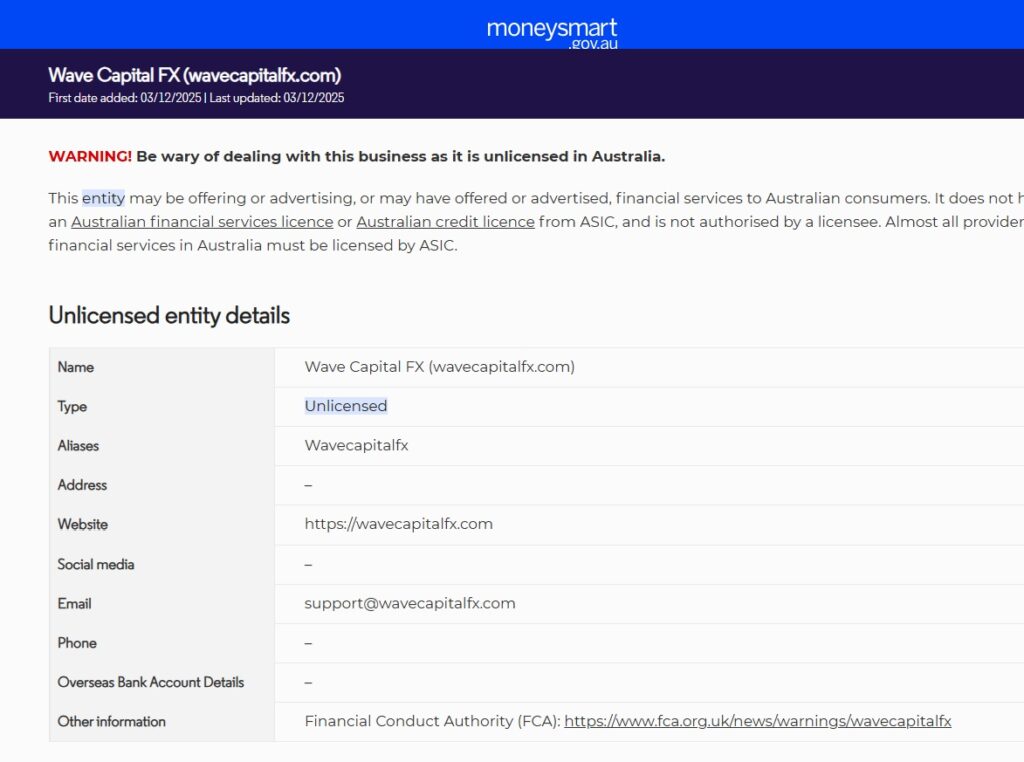

The short answer is no. In fact, Wave Capital FX is the subject of multiple warnings from the world’s most respected financial watchdogs.

Which authorities have issued warnings?

The following regulators have officially blacklisted or warned against this entity:

- FCA (United Kingdom): The Financial Conduct Authority has flagged the firm for providing financial services or products in the UK without authorization.

- ASIC (Australia): The Australian Securities and Investments Commission has placed the firm on its “Investor Alert List,” warning that it is not licensed to operate in Australia.

- Finantsinspektsioon (Estonia): The Estonian Financial Supervision Authority has also issued a public warning, stating the firm does not hold the necessary activity licenses.

Dealing with an unregulated broker means you have zero protection from the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service.

How Does the Wave Capital FX Scam Work?

Wave Capital FX utilizes a classic “investment scam” blueprint designed to extract as much money as possible from victims before disappearing.

What are their common fraud tactics?

- Unrealistic Returns: The platform attracts investors with promises of “guaranteed” high profits that remarkably outstrip market averages. However, these profits are often nothing more than figures on a manipulated digital dashboard.

- The “Tax” and “Fee” Trap: This aspect of the scam is the most destructive. When a user tries to cash out their fake profits, the platform requires payment in advance for “withdrawal fees,” “international transfer taxes,” or “activation costs.”

- Pressure Tactics: As soon as you express your interest, the “account managers” may reach out to you frequently over WhatsApp or Telegram and apply high-pressure sales tactics to persuade you to make bigger deposits.

Why Is the Lack of a License a Dealbreaker?

A financial license isn’t just a piece of paper; it’s a commitment to legal and ethical standards. Because Wave Capital FX lacks this, there is no oversight on how they handle your money.

What risks do investors face?

- Fund Mixing: It is usual that your funds are not held in separate accounts, which implies that the “broker” might be able to spend your money for their own purposes.

- No Court Path: In case the site goes off (like most scam sites do overnight), there would be no agency to make the platform return your money.

- Identity Theft: The platforms demand ‘KYC’ (Know Your Customer) documents, such as your ID and utility bills, so your personal information will likely be sold on the dark web or used in other fraudulent activities.

Final Verdict: Is Wave Capital FX Safe?

Based on the evidence from the FCA, ASIC, and Finantsinspektsioon, Wave Capital FX is a predatory scam designed to mimic a legitimate trading platform. It lacks the legal authority to operate and employs fraudulent withdrawal barriers to steal from its users.

Want to check whether a broker is trustworthy before you invest?

If you are seeking a verified source of information, analysis, and safe trading options on BrokersReporter.com, please visit us.

For more verified facts, scam reviews, and detailed guides on how to select a safe forex broker, visit us for comprehensive forex-related content and keep your investments secure.